❗Questionable prop❗

We are constantly checking customers feedback and update reliability scores of the prop firms. This one is not considered as a good choiche.

Futures trading is not an easy task and traders often have to allocate significant amounts of capital to trade properly which ultimately increases the risk of losing money. Futures prop firms, on the other hand, allow traders to mitigate these risks by accessing significant trading capital and speculating on these instruments almost risk-free. LMI or Liberty Market Investment is a futures proprietary trading company offering funded accounts based on monthly subscription.

In this LMI review of a futures prop trading company, we are going to assess the firm’s most important features such as safety, assets, accounts, platforms, fees, support, and more. After reading this review, you will be able to define whether LMI is your reliable futures prop firm.

?️Safety & Security of Liberty Market Investment

LMI Livery Market Investment prop firm reviews are lacking on the FPA, as there are no reviews or trader feedback to define the safety of the firm. The firm has no reviews or comments on the Trustpilot either which is also a red flag. The lack of trader reviews makes it extremely difficult to accurately define a firm’s safety and we advise our readers to be careful with such firms. LMI was launched in 2019 giving it years of experience in the industry which makes this lack of trader feedback even more suspicious. Liberty Market Investment is located in the UK, London.

Prop firms are not brokers and they must offer trading through regulated brokers to prevent firms from manipulating prices and ensuring high-quality trading platforms. LMI offers access to the VolFix platform. VolFix is not a broker either and it offers a simulated trading environment, meaning all LMI accounts are simulated or demo accounts and traders can not access live markets with real funds.

? Available Assets on Liberty Market Investment

Trading asset diversity is crucial for multi-asset traders. LMI Liberty Market Investment offers only one class of assets, futures. However, these futures are offered for many different asset types including currencies, equities, cryptocurrencies, commodities, interest rates, COMEX, and EUREX. Popular instruments among these futures include E-mini S&P 500, Micro E-mini S&P 500, Nikkei NKD, Micro E-mini NASDAQ, E-mini Russell 2000, Australian $, GBP, Euro FX, E-mini Euro FX, Micro Bitcoin, Gold, Silver, Crude oil, E-mini Crude Oil, and many more.

Since there are only futures on the LMI platform, all these futures trading is done through a session and traders must close all the trading positions on instruments ‘HE’, ‘LE’, ‘ZCC’, ‘ZW’, ‘ZS’, ‘ZM’, and ‘ZL’ 10 minutes before the end of the trading session. Open positions on all other instruments will be closed automatically, so traders have to be careful when the session closes.

?️ Liberty Market Investment Account Types

LMI offers traders a wide choice of funded options and each of these options is like a trading account type with slightly different profit targets and maximum drawdown limits. There is no daily risk limit at LMI which is always a nice thing to see in the prop trading scene. Liberty Market Investment funded accounts are Mini (10k), Small (30k), Medium (50k), Large (100k), Max (150k), and Extra (300k).

? Each of LMI funded options comes with different position size limits with the mini having 1, small 3, medium 5, large 10, max 15, and extra with 30 contract limits.

Profit targets and maximum trailing drawdowns are different for each account. Here is the list of profit targets for each funded option by LMI:

- Funded amount: 10k (Mini) – profit target: 700 USD

- 30k (Small) – 2,000 USD

- 50k (Medium) – 3,000 USD

- 100k (Large) – 6,000 USD

- 150k (Max) – 9,000 USD

- 300k (Extra) – 20,000 USD

Here is the maximum trailing drawdown for each funded account by LMI:

- Funded amount: 10k (Mini) – max trailing drawdown: 500 USD

- 30k (Small) – 1,500 USD

- 50k (Medium) – 2,000 USD

- 100k (Large) – 3,000 USD

- 150k (Max) – 4,500 USD

- 300k (Extra) – 7,500 USD

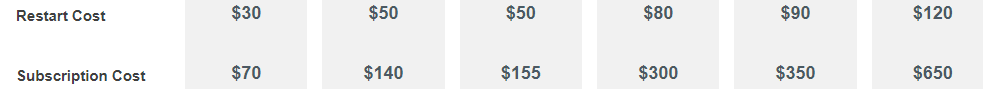

LMI has consistency rules preventing traders from making more than 40% of total profits in one single trading day. This is to ensure only traders with strict risk discipline become funded and prevent gambling practices. Traders can continue trading on a challenge account after 30 days indefinitely until they hit the profit target. If trader fails to pass the challenge they can reset the challenge by paying a small fee which is much cheaper than the initial monthly subscription fee.

? Pricing on Liberty Market Investment

LMI Liberty Market Investment offers monthly subscriptions for its funded challenges just like other futures prop firms. The pricing is very competitive from LMI and offers traders funded accounts from 10k for just 70 dollars per month which is one of the lowest in the futures prop trading scene right now.

? Here is the fee list for each funded account option by Liberty Market Investment:

- Funded amount: 10k (Mini) – monthly subscription: 70 USD

- 30k (Small) – 140 USD

- 50k (Medium) – 155 USD

- 100k (Large) – 300 USD

- 150k (Max) – 350 USD

- 300k (Extra) – 650 USD

LMI also allows traders to reset their challenge if they fail by paying a tiny amount for each funded account including $30, $50, $50, $80, $90, and $120 for each funded account from 10k to 300k USD.

Liberty Market Investment profit split is set to 90% after the first 30,000 USD withdrawal. The first 30,000 USD withdrawals are 100% going to traders. The one downside here is that LMI accepts wire transfers which are lengthy but also safe.

? Platforms and Mobile Trading on Liberty Market Investment

LMI provides traders with plenty of futures on diverse assets. Traders can speculate on all these futures within one platform which was designed specifically for futures and can therefore take advantage of its diverse functionality.

The firm allows traders to access the VolFix platform which is provided by the technology company that offers platform and price data. This platform is an all-in-one trading platform offering market depth and advanced trade management. Real-time analytics, alerts, and plenty of indicators. These tools can be used to analyze markets comprehensively before opening trading positions which is advantageous.

? Education and research tools offered by Liberty Market Investment

There are no educational resources on the LMI, but the firm offers a trading blog with useful posts. There are also many tools assisting traders to measure their performance via apps and plugins in the VolFix platform. All the tools are offered through the dashboard, allowing traders to always be in control of their risks and performance.

? Customer Support on Liberty Market Investment

There is probably one of the best help centers in the prop industry on the LMI website. All the themes and topics are very well-ordered allowing traders to find everything they need about the firm.

When it comes to customer support the firm offers email support but lacks live chat which is a significant disadvantage. Both the website and the support are available in plenty of languages which is also very useful for international customers.

❗Questionable prop❗

We are constantly checking customers feedback and update reliability scores of the prop firms. This one is not considered as a good choiche.

❓ FAQ on Liberty Market Investment

Is LMI a safe platform?

What is the LMI minimum deposit?

Does LMI have a mobile trading app?