The Indian prop trading market is a growing one. Choosing between the numerous companies operating in the country can prove challenging for beginners.

Find out which proprietary trading firms offer the best terms, fees, and features to clients based in India.

Proprietary trading is an industry that is growing in popularity all over the world, with India emerging as one of the biggest markets.

With high funding limits and convenient trading terms, prop trading allows you to access a large sum of capital and keep most of the profits you generate from trading a variety of instruments, such as forex pairs, CFDs, futures, and more.

Beginner prop traders may be wondering about the best prop firms in India and what they have to offer. In general, when selecting Indian prop firms, it is important to evaluate them on the basis of several key criteria, such as:

- What is the maximum possible amount of funding available?

- Does the firm support MetaTrader 4?

- What are the profit targets and drawdown limitations for traders?

- How often can you make withdrawals and what is the profit split?

Using these factors can help you filter through a large number of proprietary trading firms in India and choose the one that offers the best possible terms for your expectations and financial objectives.

Top 5 Proprietary Trading Firms in India

Dozens of proprietary trading firms operate in India, offering funded accounts, MT4, and a variety of technical and educational features, keeping a minimum of 50% of the trading profits they generate.

Each prop firm available to traders in India holds a competitive advantage in a particular aspect of prop trading. Here are 5 of the best proprietary trading firms in India by category:

- Top prop firm in India for maximum funding – FTUK

- The best forex prop firm in India – Blue Guardian

- Best prop trading firm in India for low fees – Funded Next

- Best proprietary trading firm in India for evaluation simplicity – Audacity Capital

- Top prop trading firm in India for fast payouts – E8 Funding

E8 Funding

Arguably one of the top proprietary trading firms in India, E8 Funding offers plenty of value for money to its clients in the country, who can start getting paid in as little as 8 days from signing up with the firm.

Founded in 2021, the firm has quickly gained popularity and now offers its funded trader program to thousands of proprietary traders worldwide.

Here are some of the key terms E8 Funding offers to its clients in India:

- Maximum account balance of $400,000, with an option to scale up to $1 million

- Access to MetaTrader 4 and MetaTrader 5 as the primary trading platforms

- Three base account currencies – USD, GBP, and EUR

- First payment after only 8 days of gaining access to a funded account

- No minimum trading day requirement

- Risk scaling plan with drawdown up to 14%

- The opportunity to keep 80% of the profits generated

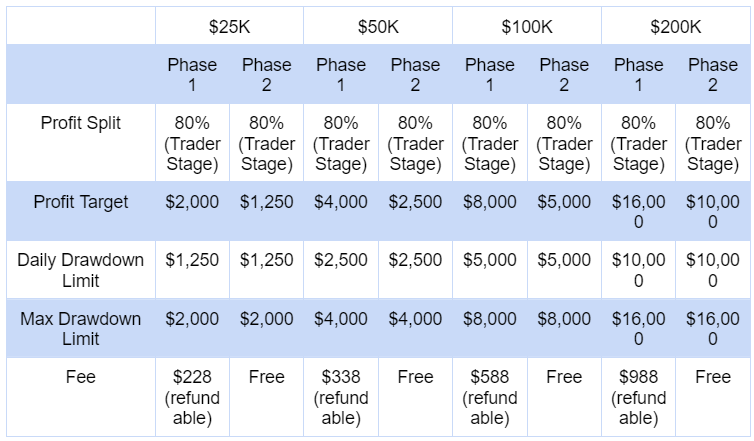

Traders who sign up with E8 Funding should expect two core accounts types – the E8 Account, and the E8 Track, with the latter offering a three-phase evaluation at half the price.

The firm offers 4 funding levels – $20,000, $50,000, $100,000, and $200,000, which can be scaled up to $400,000 and $1 million.

? E8 Account

- 80% profit split across all account sizes after the completion of the evaluation phases

- 8% profit target for Phase 1 and 5% for Phase 2

- Daily drawdown limit of 5% and maximum drawdown limit of 8%

- Account fees that are refunded after the completion of Phase 2

? E8 Track

- 80% profit split across all account sizes after completing the evluation phases

- 3-phase evaluation with lower fees

- 8% profit target for Phase 1 and 5% for Phases 2 and 3

- Daily drawdown limit of 5% and maximum drawdown limit of 8%

- Account fees are refunded after the completion of Phase 3

Audacity Capital

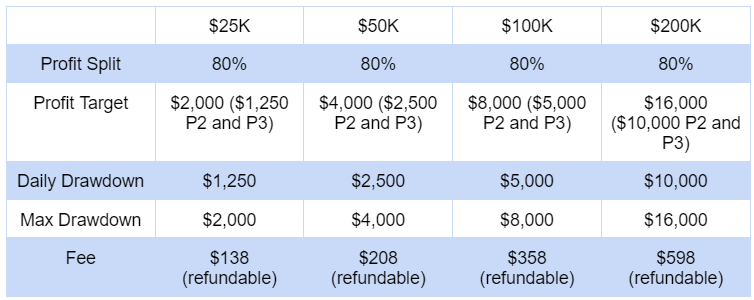

Audacity Capital offers a 1-step trading challenge, which is the most streamlined prop trading evaluation in India.

As one of the top forex prop firms in India, Audacity Capital gives traders the opportunity to get funded up to $500,000, with the traders keeping 50% of the generated profits.

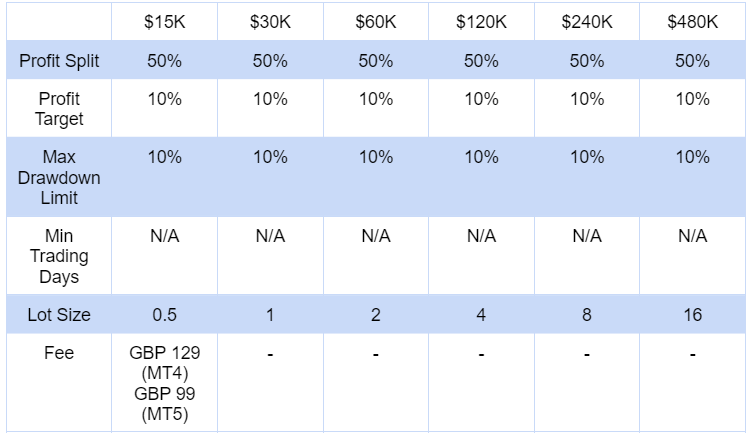

However, traders only pay for the $15,000 account tier and can gradually scale up their balance to $480,000, after completing the 6 stages of the challenge.

Traders who can demonstrate experience managing live accounts and have a consistent strategy with proper risk management, can get funded for as little as GBP 99 for MetaTrader 5, or GBP 129 for MetaTrader 4 accounts.

Among an extensive list of prop firms, Audacity Capital stands out as one of the most affordable prop firms in India forex traders can access today.

? Sign Up at Audacity Capital Here!

? Account sizes and trading terms

- One account with 6 challenge stages

- 50% profit split

- Funding levels ranging from $15,000 (Stage 1) to $480,000 (Stage 6)

- 10% profit target across all challenge stages

- Only pay for Stage 1 and scale up to $480,000

- No minimum trading days

? Sign Up at Audacity Capital Here!

Blue Guardian

Blue Guardian holds a high spot among prop firms in India and offers funded accounts up to $200,000 at affordable fees, all of which are refundable upon completion of the trading challenge.

Blue Guardian only keeps 15% of the profits generated by traders, who can choose between three distinct evaluations – Unlimited, Elite, and Rapid.

Each of these evaluation types offer different terms to clients. For example, the Rapid Evaluation is designed for traders who are looking for a fast-track challenge.

Additional notable features offered to Blue Guardians include:

- Bi-weekly profit payouts upon completing the relevant evaluation challenge

- A scaling plan of up to $2 million in funding, unlocked after 3 months of 12% or more in generated profits, distributed in 30% increments

- No restrictions on trading strategies, EAs, trade copiers, or news trading

- A built-in equity protector to avoid hitting the maximum daily loss limit

A solid selection of account types, flexible trading terms, and additional features make Blue Guardian one of the best proprietary trading firms in India.

? Sign Up at Blue Guardian Here!

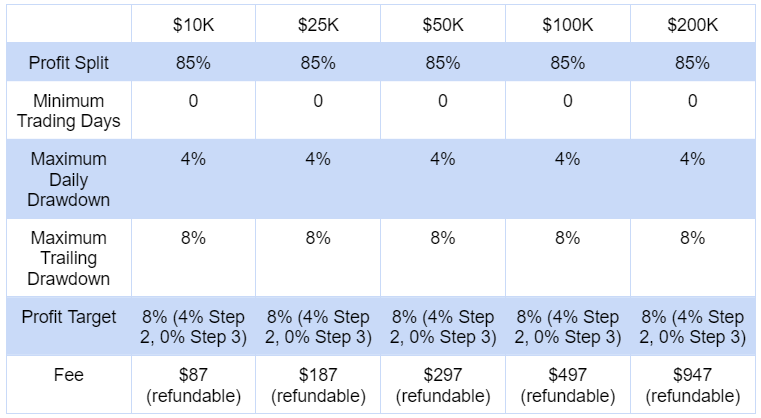

? Unlimited Evaluation

- The Unlimited Evaluation challenge offers unlimited retries and 5 funding levels – $10,000, $25,000, $50,000, $100,000, and $200,000

- There are no minimum trading day requirements

- Profit targets range from 8% for Step 1, 4% for Step 2, and 0% for Step 3

- All account fees are refundable upon completion of the 3 steps of the challenge

- A daily drawdown of 4%, and an overall drawdown of 8% allowed

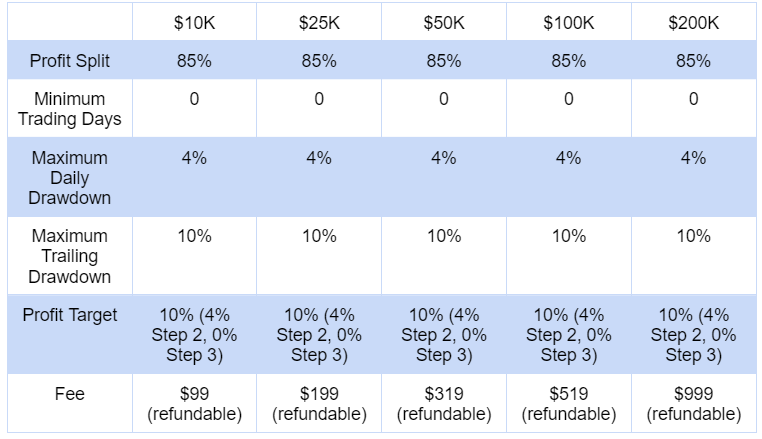

? Elite Evaluation

- The same account funding levels as the Unlimited Evaluation

- A 10% profit target for Step 1, 4% for Step 2, and 0% for Step 3 of the evaluation

- A daily drawdown of 4% and overall drawdown limit of 10%

- Slightly higher account fees, starting at $99, as opposed to $87 for the Unlimited Evaluation

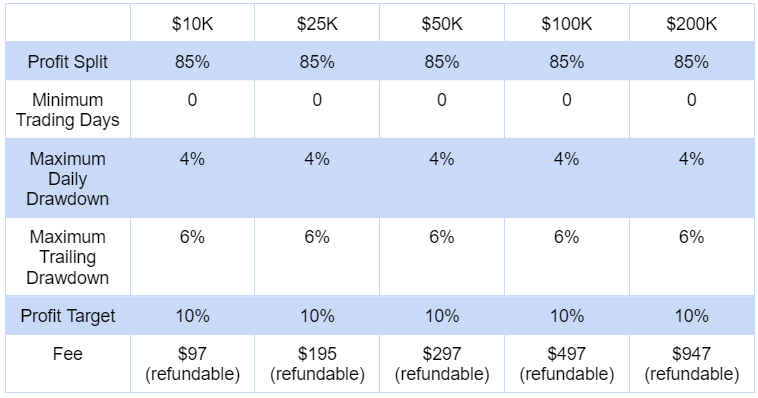

☄️ Rapid Evaluation

- Less challenge steps and faster route to funding

- A profit target of 10%

- A daily drawdown limit of 4% and an overall drawdown limit of 6%

? Sign Up at Blue Guardian Here!

Instant Funding

Instant Funding is the best prop firm in India for traders who are interested in accounts with lower base value, as the smallest funding level starts as low as $1,250.

The highest funded account gives traders $200,000, which can be scaled up to as much as $2.5 million.

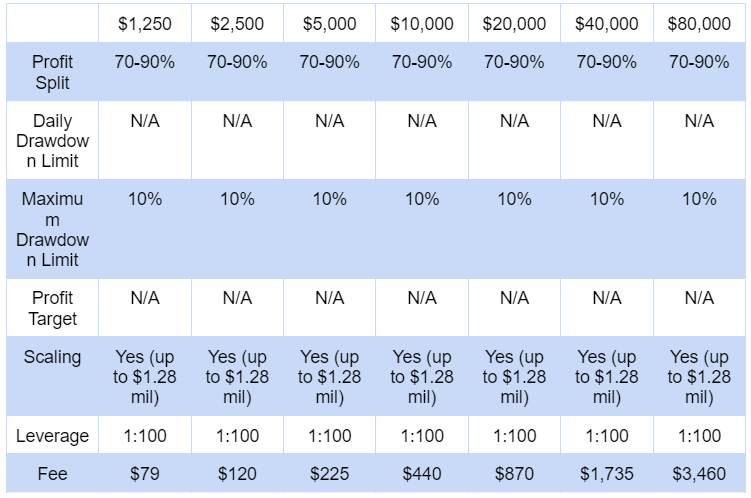

There are three distinct types of evaluations available – Instant Funding, One-Phase, and Two-Phase, with the Instant Funding evaluation offering the smallest funded accounts with a maximum funding of $80,000, which can be scaled up to $1.28 million.

Both MetaTrader 4 and 5 are readily available and beginners can access the trader dashboard, which includes educational content and data regarding the instruments tradable on the platform.

? Sign Up at Instant Funding Here!

? Instant Funding evaluation

- Smallest account values starting at $1,250 and up to $80,000, scalable to $1.28 million in total funding

- One-step evaluations for increased speed

- Profit splits between 70-90%, depending on the account level

- Leverage of 1:100 available on forex pairs

- No daily drawdown limitations

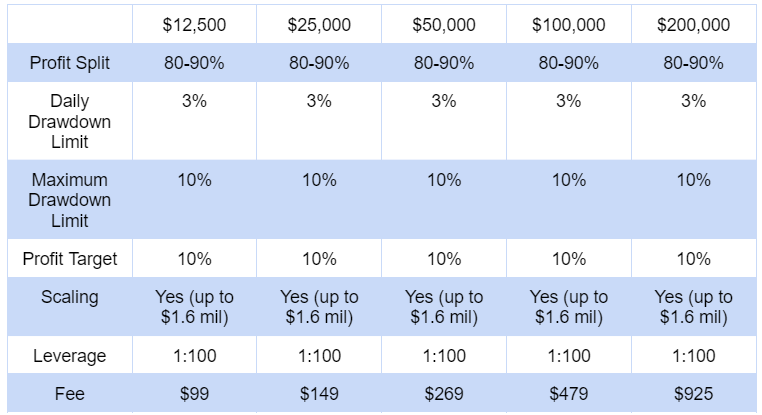

1️⃣ One-Phase evaluation

- Profit splits starting from 80%

- A 3% daily drawdown and 10% total drawdown limitation

- 10% profit target

- Funding levels ranging from $12,500 to $200,000, with an option to scale up to $1.6 million

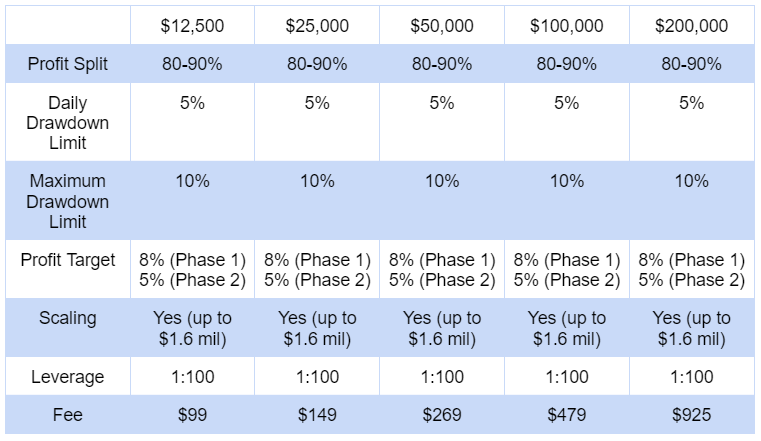

2️⃣ Two-Phase evaluation

The two-phase evaluation introduces a 5% daily drawdown limit and profit target of 8% for Phase 1 and 5% for Phase 2.

All other terms are the same as for the one-phase evaluation. The fees per funded account are also unchanged.

? Sign Up at Instant Funding Here!

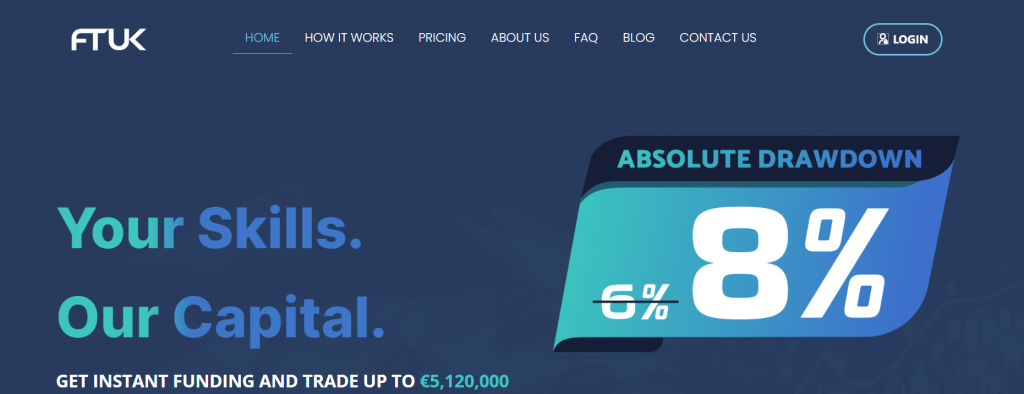

FTUK

A popular firm among global traders, FTUK is among the top proprietary trading firms in India, offering streamlined funded accounts to traders in India and beyond, with an exceptional scaling plan of up to $5,760,000 in gross funding.

The firm offers two account types using its Evaluation and Instant Funding Programs, with each of them allowing trousers to fast-track their way towards high account balances via the FTUK scaling plan.

Each of the 4 funded accounts have scaling limitations in place. For example, the $14,000 account can be scaled up to a maximum of $896,000.

Overnight and over the weekend positions are available for both account types, which lends itself to more flexibility FX trading strategies.

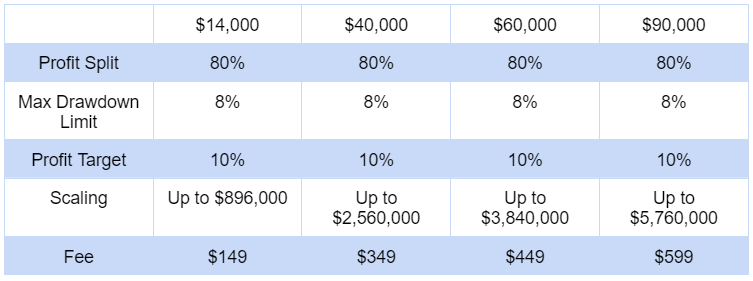

? Evaluation Program

- Profit split of 80% in favor of the trader

- Maximum drawdown limit of 8% and a 10% profit target

- Four account funding levels – $14,000, $40,000, $60,000, and $90,000

- Scaling available for all funding levels

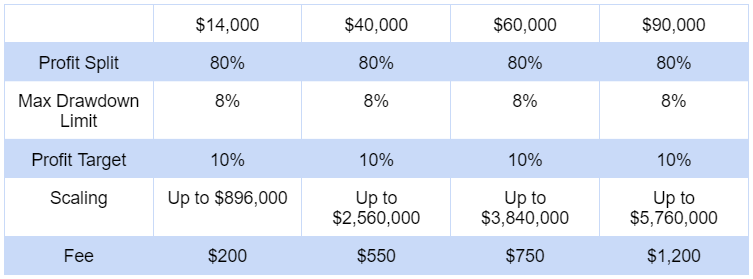

? Instant Funding Program

The terms for the Instant Funding Program are largely unchanged from the Evaluation Program, with a difference in account fees.

Due to the instant access offered by these accounts, the one-time fees for each funding level are also considerably higher than those of the Evaluation Program.

Lark Funding

For traders seeking a more dynamic funding structure, Lark Funding is one of the best prop trading firms in India, offering 1, 2, and 3-Stage evaluations and a total funding of up to $200,000, which can be scaled up to $600,000.

The lowest account tier offered by Lark Funding is the $5,000 account, which charges $50 when choosing the 3-Stage evaluation.

Traders who are looking for a faster route can choose the 1-Stage Evaluation, which comes with comparable terms as the rest of the Lark Funding accounts – with a 80-90% profit split and tight 6% drawdown limitation.

The selection of instruments is diverse and offers plenty of value to different styles of trader, who can access the following asset classes:

- 40 forex pairs

- Commodities like gold, silver, and oil

- Stock indices

- Largest stocks from the NYSE, Nasdaq, LSE, Australian, and XETRA exchanges

? Sign Up at Lark Funding Here!

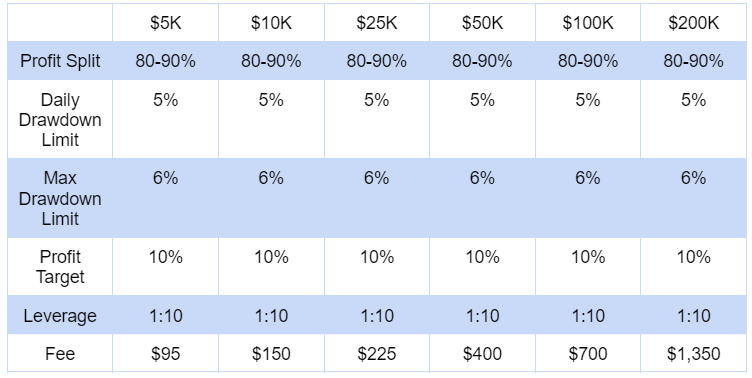

1️⃣ 1-Stage Evaluation

- The fastest and most expensive evaluation, starting at $95 for the $5,000 account

- Maximum daily drawdown of 5% and overall drawdown limit of 6%

- 10% profit target across all account levels

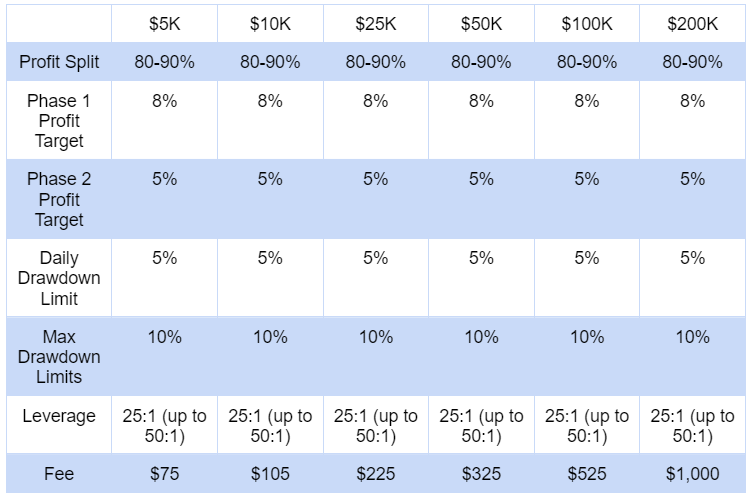

2️⃣ 2-Stage Evaluation

For the 2-Stage Evaluation, there are different profit targets for Phases 1 and 2 – 8% and 5%, respectively.

The fees charged for the 2-Stage Evaluation are also considerably lower, with higher leverage and more permissive maximum drawdown limitations.

? Sign Up at Lark Funding Here!

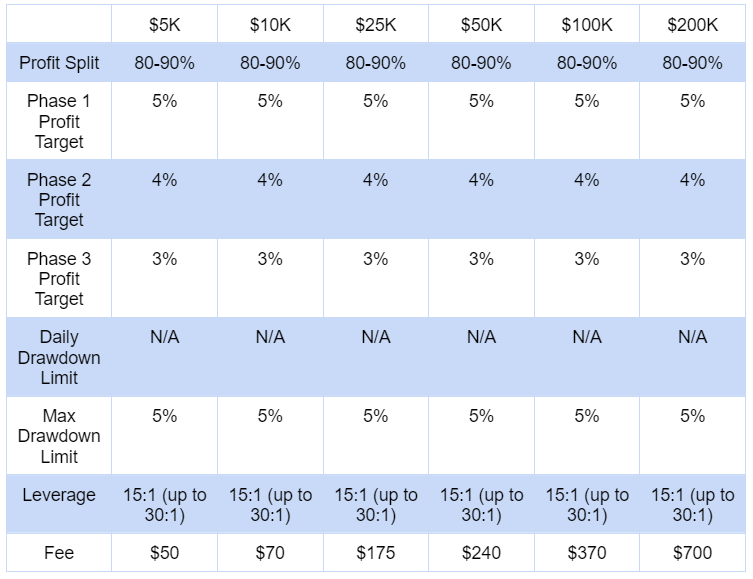

3️⃣ 3-Stage Evaluation

- Lower account fees due to longer evaluation stage

- 80-90% profit split and profit targets of 5%, 4% and 3%, respectively

- No daily drawdown limitations

- 1:15 leverage, scalable to 1:30

? Sign Up at Lark Funding Here!

Ment Funding

For traders who are interested in Indian prop firms that do not have any time limits and offer a streamlined scaling plan, Ment Funding could be the best choice.

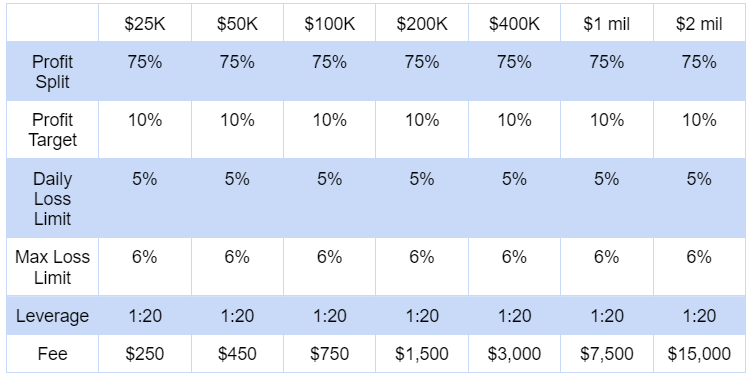

With seven different funding levels, the firm offers plenty of diversity to its clients, which is combined with the speed of a 1-step evaluation.

The lowest funding level at Ment Funding starts at $25,000, while maximum funding is capped at $2 million.

The standard profit split for each account is 75% in favor of the trader, which can be scaled up to 90% in later stages after delivering consistent profits.

There are no minimum or maximum trading day limitations on any of the accounts offered by Ment Funding.

?Sign Up at Ment Funding Here!

? 1-Step Evaluation

- Account funding ranging from $25,000 all the way up to $2 million

- 1:20 leverage available

- 5% daily and 6% overall loss limit

- 75% profit split across all funding levels, scalable to 90%

? Sign Up at Ment Funding Here!

Fidelcrest

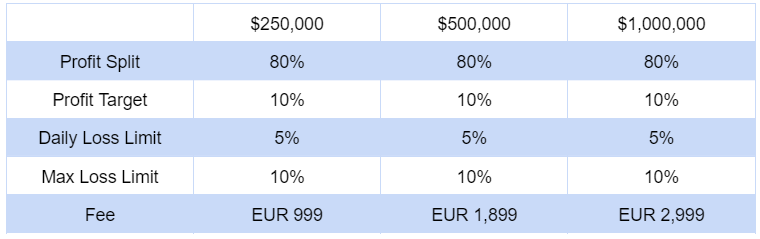

Widely considered as one of the top 10 proprietary trading firms in India and the world, Fidelcrest offers high funding limits for its accounts, starting as high as $250,000, which can be scaled up to a $2 maximum funding level.

Fidelcrest accounts are divided in terms of risk profile – offering Normal and Aggressive risk accounts.

The maximum available funding for Fidelcrest accounts is $1 million and account fees start at EUR 999 for the $250,000 Normal Risk Pro Trader account.

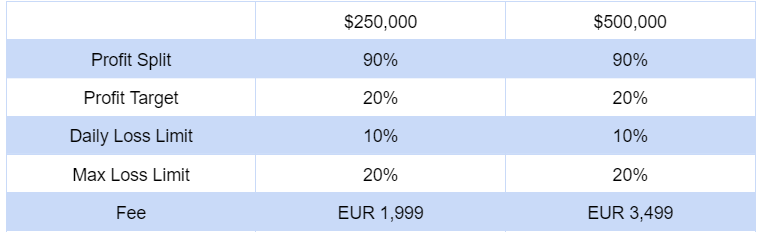

Fielcrest is characterized by fast-track evaluations and high limits on accounts, with the Aggressive Risk accounts allowing for a 20% maximum drawdown in exchange for a 20% profit target.

The use of robots and EAs may be granted by the Risk Team, but this is not one of the standard features offered by Fidelcrest.

FX, metals, stock CFDs and commodities are among the 175+ instruments available to Fidelcrest clients.

? Pro Trader Normal

- Three funding levels – $250,000, $500,000 and $1,000,000

- 80% profit split on all three funded accounts

- 10% profit target, 5% daily and 10% maximum loss limits

? Pro Trader Aggressive

- Two funding levels – $250,000 and $500,000

- 90% profit split in favor of the trader

- 20% maximum loss limit and a daily loss limit of 10%

- 20% profit target on both account funding levels

Forex Prop Firm

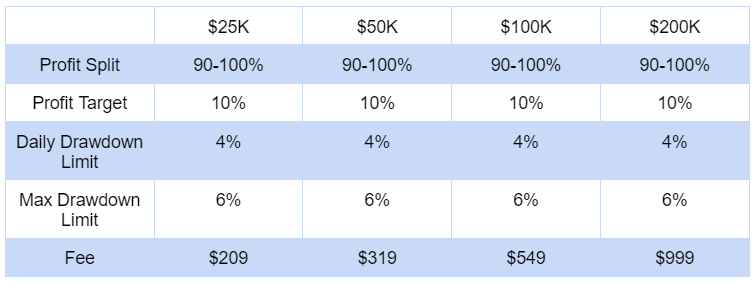

Forex Prop Firm offers a balanced selection of funded accounts to traders in India, with simulated funding up to $200,000, with profit shares from 90% up to 100%.

There are four different funding challenges – 1-Step, 2-Step, No Time Limit, and Instant Funding.

There are no restrictions on trading strategy and EAs, overnight holdings, and news trading are all allowed.

MetaTrader 4 and MetaTrader 5 are both available to use for traders who sign up at FPF.

Traders have access to a total of over 1,000 instruments, which includes forex pairs, commodities, metals, CFDs, and more.

The profit split upon signing up with the firm is 90% and the scaling plan allows for as much as $10 million in cumulative funding.

? Sign Up at Forex Prop Firm Here!

1️⃣ 1-Step Challenge

- Profit split starting from 90% across all accounts

- A profit target of 10%

- Daily drawdown limit of 4% and an overall drawdown limit of 6%

2️⃣ 2-Step Challenge

2️⃣? 2-Step Challenge (No Time Limit)

The No Time Limit iteration of the 2-Step challenge removes the maximum trading day limitation in exchange for a higher profit target of 10%.

The minimum number of trading days is also reduced to 3 from 5, while 5% daily drawdown limits are introduced.

When it comes to account fees, the No Time Limit challenge is more affordable than the standard 2-Step challenge across all funding levels.

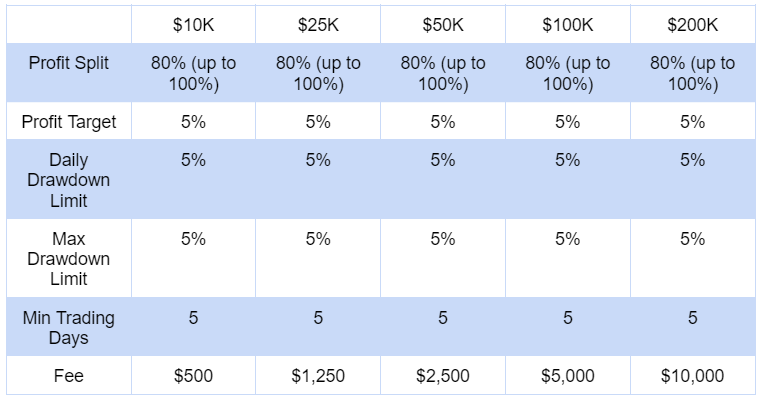

⚡ Instant Funding

The Instant Funding route introduces a $10,000 account tier, with a minimum profit target of 5% for withdrawal eligibility, as well as fixed daily and absolute drawdown limits of 5% as well.

However, the fees for Instant Funding accounts are also significantly higher when compared to other challenges on FPF, with the lowest $10,000 account costing $500.

? Sign Up at Forex Prop Firm Here!

Funded Next

Funded Next offers attractive terms to clients in India, who can access up to $300,000 in funding and keep up to 95% of the generated profits. The total funding can be scaled up to as much as $4 million.

The firm also has a guaranteed payout policy in place, where they pay an extra $1,000 to the client if they do not receive their profits within 24 hours of requesting a withdrawal.

Among the top prop trading firms in India, Funded Next stands out by its profit sharing agreement, which rewards traders even during challenge phases, allowing them to keep 15% of the profits.

There are no time limits during the challenge phase and drawdown is calculated in accordance with the trader’s balance.

The firm offers three types of trading challenges – Stellar, Evaluation, and Express, which differ in fees and evaluation speed.

? Sign Up at Funded Next Here!

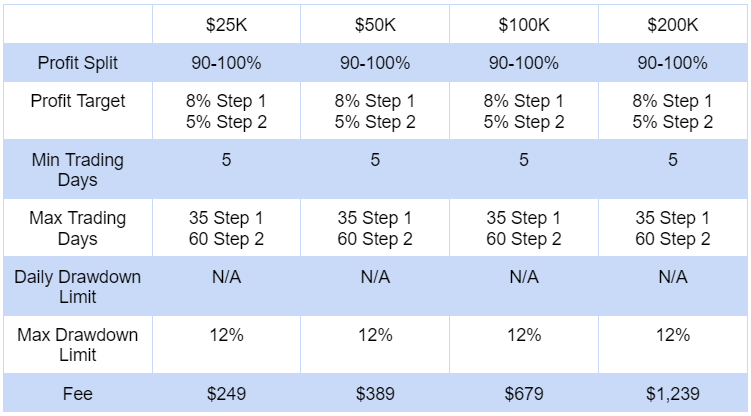

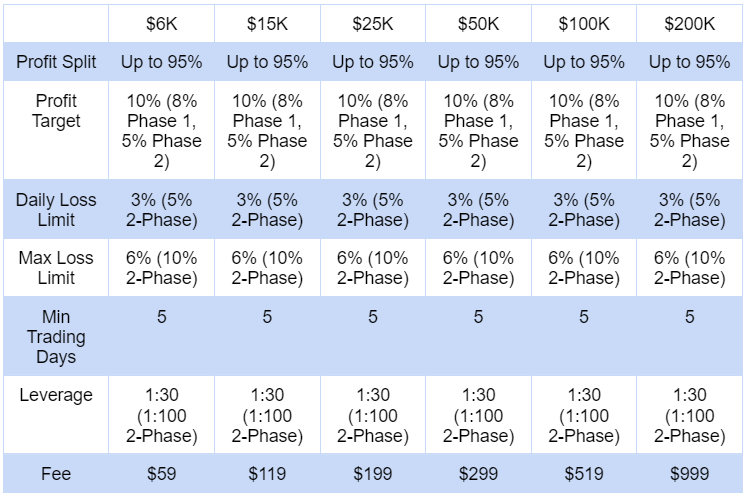

? Stellar Challenge

The Stellar Challenge is the most popular trading challenge offered by Funded Next and includes 6 distinct funding levels.

Each of the funding challenges come with 1-phase and 2-phase options, as well as a swap-free version.

Traders can keep up to 95% of the profits they generate and a minimum of 5 trading days are required for the challenge to be eligible.

A 1:30 leverage is available for 1-phase challenges, while the 2-phase challenge increases the leverage limit to 1:100.

The Stellar Challenge also allows for weekend holdings and trading during major news events, while the use of trade copiers and expert advisors is also permitted.

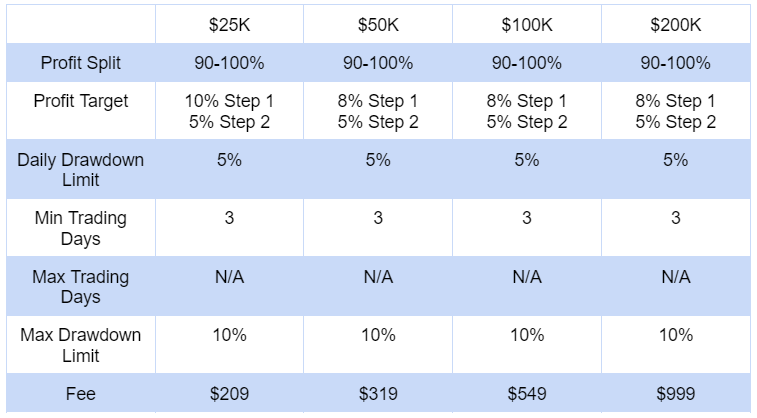

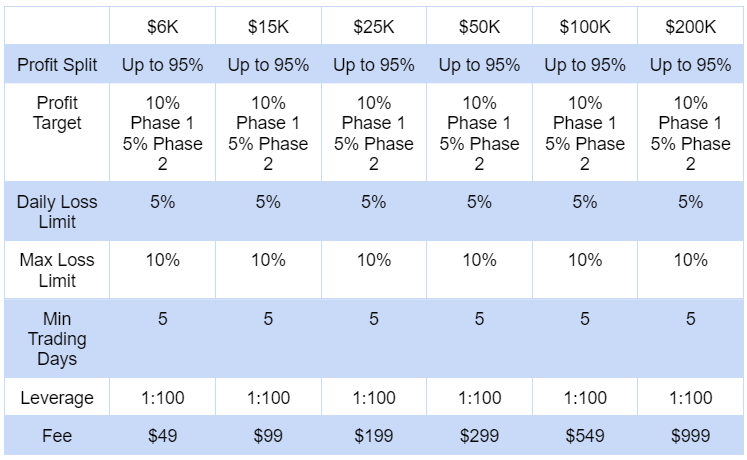

? Evaluation

- The Evaluation challenge is a 2-phase prop evaluation and traders can keep up to 95% of the generated profits

- 10% profit target for Phase 1 and 5% for Phase 2

- A daily loss limit of 5% and an overall loss limit of 10%

- Leverage up to 1:100 available

- Account fees starting at $49 for the $6,000 evaluation

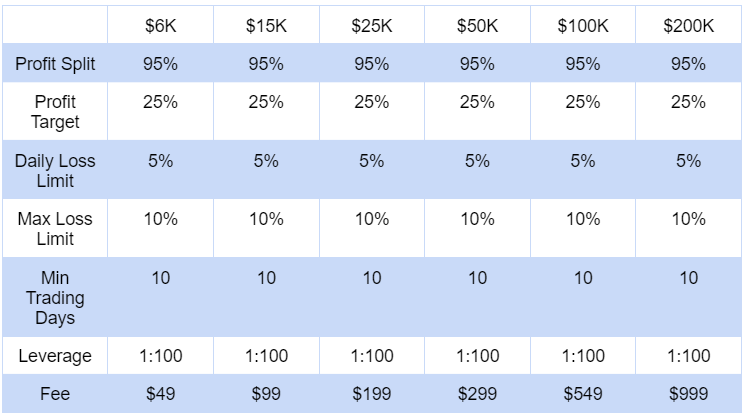

? Express

- Express is the fastest evaluation program with a minimum 10 trading day requirement

- A 25% profit target for every funding level

- A daily loss limit of 5% and an overall loss limit of 10%

- 1:100 leverage available for all evaluation levels

? Sign Up at Funded Next Here!

FundYourFX

FundYourFX is one of the top proprietary firms in India and offers a maximum funding limit of $2 million, keeping 90% of the profits generated.

Clients of FundYourFX start trading on live accounts as soon as they pass the evaluation phase and all account fees are refunded after traders generate 10% in profits three times.

FundYourFX offers three different trading plans and traders only pay for Level 1 of the challenge and can scale up as they go through levels 2-6, which means that account fees remain competitive.

The Starter Plan can be scaled up to $500,000, Standard to $1 million, and Professional to $2 million.

Accounts at FundYourFX frequently go on sale and traders can take advantage of discounted prices when choosing an evaluation plan. Profit payouts are made on a weekly basis.

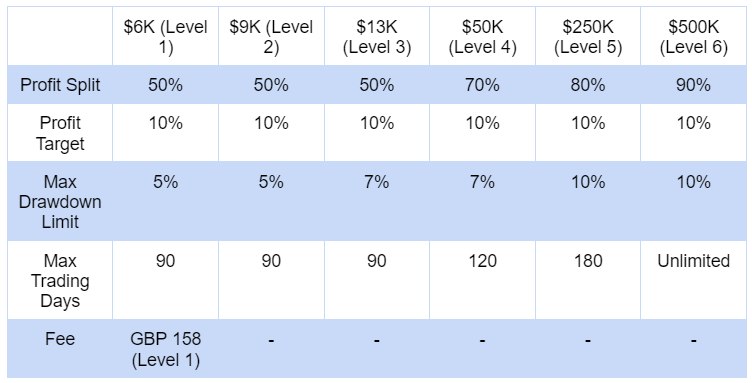

? Starter Plan

The Starter Plan is an entry-level challenge that comes with the lowest funding level available at FYF at $6,000 for Level 1.

Traders need to complete each level to increase their funding and cannot by the higher funding levels as with other prop firms.

The level up plan allows for a maximum funding increase up to $500,000 by Level 6.

Profit splits, as well as trading terms, will vary significantly between levels. For example, Level 1 has a profit split of 50%, while Level 6 offers 90%.

The maximum trading day restrictions also increase as the trader levels up, with Level 6 having no such restrictions.

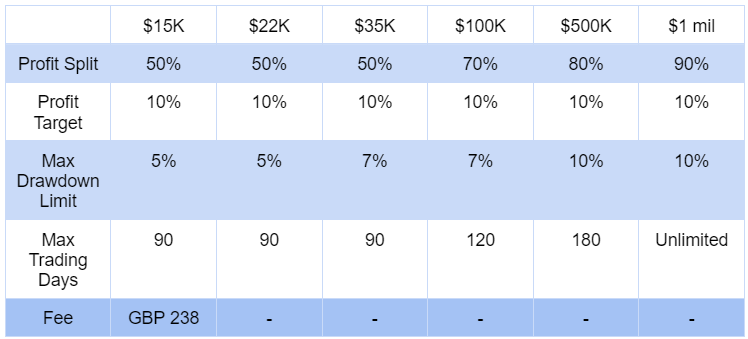

? Standard Plan

- Maximum funding up to $1 million by Level 6

- Only pay for Level 1 (GBP 238 discounted price)

- 10% profit target and a maximum drawdown limit of 5%

- 50% profit split for Level 1, up to 90% for Level 6

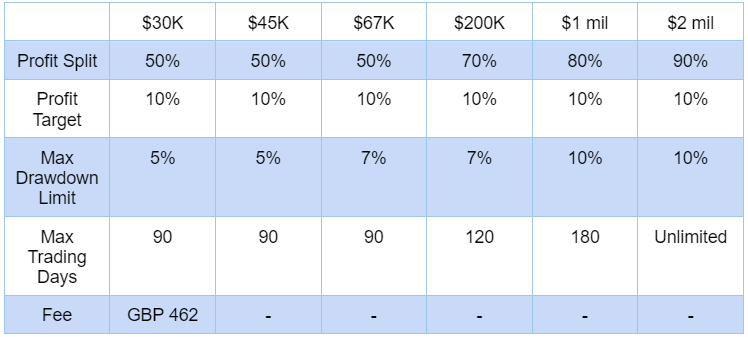

?️ Professional Plan

The Professional Plan, which starts at a discounted price of GBP 462, offers higher minimum funding levels and the ability to scale up to as much as $2 million in account value by Level 6.

As for the general trading terms, such as profit targets and drawdown limits, they are unchanged across all 3 FundYourFX account plans.

Top 5 Proprietary Trading Firms in India With the Highest Funding

The Indian prop trading market is home to dozens of international firms with thousands of clients from all over the world.

Some of them focus on smaller funded accounts and convenient scaling plans, while others offer high funding outright.

Here are 5 Indian prop firms that offer the highest amount of funding through scaling:

- Forex Prop Firm – $10,000,000

- FTUK – $5,760,000

- Funded Next – $4,000,000

- Instant Funding – $2,500,000

- Blue Guardian – $2,000,000

Each of these proprietary trading firms offer multiple funded accounts and evaluation plans, which can be scaled up to $2 million and above.

FAQ on Proprietary Trading Firms in India

Can you trust proprietary trading firms in India?

How much money can I make with Indian prop trading firms?

Do prop trading firms in India have MetaTrader 4?