When speculating on financial markets, having sufficient trading capital alongside a deep knowledge of markets is critical. Prop trading firms offer traders the unique possibility to access funded accounts with significant capital and trade markets almost risk-free.

Funded Trading Plus is a proprietary trading company that has been around since 2013, making it one of the most experienced props out there. The firm offers traders diverse funded options and an 80% profit split, and we are going to review this firm in more detail below.

After reading this review, traders will gather all the needed information to assess the firm’s important features including funded options, safety, rules, assets, platforms, fees, education, support, and more. This review is completely unbiased and is not sponsored by Funded Trading Plus.

?️Safety & Security of Funded Trading Plus

Safety is one of the most essential factors when evaluating a prop firm’s services. It is even more significant than rules and pricing. Funded Trading Plus has very positive reviews from retail traders, which is crucial for defining the firm’s safety and legitimacy. While there are no reviews on the FPA, the firm has a 4.7 score on Trustpilot, which is among the highest scores any prop trading firm can get. There are more than 2000 reviews on Trustpilot and 92% of these reviews are 5-star ratings, a testament to the firm’s reliability and attractiveness.

Funded Trading Plus offers trading services through regulated brokers and liquidity providers, eliminating the risks of price manipulation and conflict of interest. The firm is based in London, UK, and was launched in 2013 giving it decades of experience in the prop trading industry which is one of the most crucial indicators of safety.

Overall, Funded Trading Plus seems a very reliable prop trading brand because of its experience in the industry, positive trade reviews, and regulated brokers as partners.

? Available Assets on Funded Trading Plus

Trading asset diversity plays an important role in prop trading. This is because different traders have different trading styles and want to speculate on different pairs and instruments.

Funded Trading Plus allows traders to access diverse assets through its partner brokers, including Forex pairs, commodities, indices, and cryptos. Forex pairs include majors, minors, and even exotics. Commodities include spot metals such as XAUUSD and XAGUSD, and oils Brent and WTI. Additionally, 9 indexes and 4 popular cryptos are offered at the moment. The leverage varies depending on the asset class selected, and the maximum is up to 1:30. Surely, Forex pairs can be traded with up to 1:30, while cryptos typically have much lower leverage levels because of their volatility.

Overall, Funded Trading Plus provides the possibility to access popular markets and trade with flexible leverage.

?️ Funded Trading Plus Account Types

Funded account diversity allows traders to select the account according to their trading needs. For example, swing traders and day traders might prefer funded options that allow them to hold open positions during major news, overnight, and over the weekends. Scalpers will only need the lowest spreads and commissions to make profits.

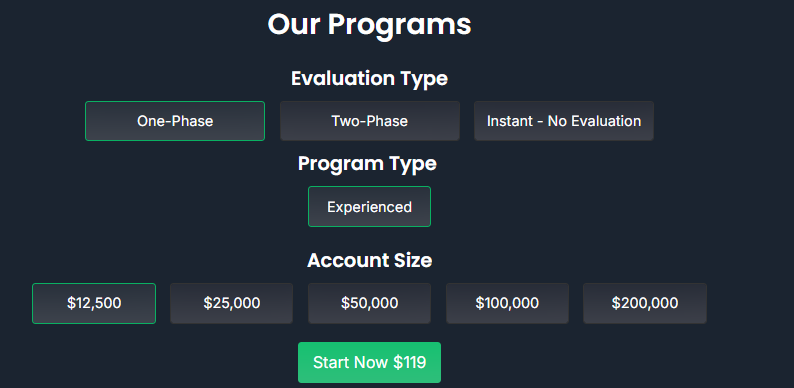

Funded Trading Plus offers several funded account types including One-Phase, Two-Phase, and Instant — No Evaluation options. Beginners might prefer 1-step or 2-step accounts, while seasoned professionals will opt for instant accounts. This approach allows Funded Trading Plus to target both beginners and experienced traders.

? Funded Trading Plus One-Phase funded account rules include:

- Funded options — 12,5k, 25k, 50k, 100k, 200k

- Profit-sharing — 80%

- Daily risk limit — 4%

- Maximum drawdown — 6%

- Profit target — 10%

- Minimum trading days — 0

- EAs allowed — Yes

- Maximum lot size — no hard limit

- Holding over the weekend — yes

- Stop loss required — no

As we can see, the 1-step account is for experienced traders who can trade under slightly stricter risk limits.

? Funded Trading Plus Two-Phase funded account rules are as follows:

- Funded options — 25k, 50k, 100k, 200k

- Profit-sharing — 80%

- Daily risk limit — 4% premium, 5% advanced

- Maximum drawdown — 8% premium, 10% advanced

- Profit target — 8% premium, 10% advanced

- Copy trading — No (all accounts)

- Minimum trading days — 0 for both

- EAs allowed — Yes

- Holding over the weekend — Yes for premium, No for advanced

- Stop loss required — No

Two-phase funded accounts are Premium and Advanced, where premium accounts cost less than the latter.

? Funded Trading Plus Instant — No Evaluation funded account requires traders to follow:

- Funded options — 5k, 10k, 25k, 50k, 100k

- Profit-sharing — 80%

- Daily risk limit — 6%

- Maximum drawdown — 6%

- Profit target — None

- Minimum trading days — 0

- EAs allowed — Yes

- Holding over the weekend — No

- Stop loss required — No

Funded Trading Plus Instant accounts are targeted for absolute masters who can start trading for profits immediately without an evaluation process. This account is not strict, requires a 6% daily risk limit, and has no profit target.

? Pricing on Funded Trading Plus

Funded Trading Plus has different prices for each of their funded account types and funded options offered. The lowest fee starts from $119 for the One-Phase account with a funded amount of 12,500 dollars. Let’s briefly list pricing for each of the funded account types and options. All fees are one-time fees and paid once. This is common for Forex prop trading firms, unlike futures props that charge monthly subscription fees.

? Funded Trading Plus One-Phase funded account fees:

- Funded amount: $12,500 — one-time fee: $119

- $25,000 — $199

- $50,000 — $349

- $100,000 — $499

- $200,000 — $949

? Funded Trading Plus Two-Phase Premium funded account fees:

- Funded amount: $25,000 — one-time fee: $247

- $50,000 — $397

- $100,000 — $547

- $200,000 — $1,097

? Funded Trading Plus Instant — No Evaluation funded account fees:

- Funded amount: $5,000 — one-time fee: $225

- $10,000 — $450

- $25,000 — $1,125

- $50,000 — $2,250

- $100,000 — $4,500

Funded Trading Plus periodically offers discounts and sale events, where traders can get funded accounts even cheaper. This can be especially useful for beginner traders who want to start trading but lack a budget. The One-Phase accounts are the cheapest and only require traders to hit the profit target without reaching risk rules, making them most attractive to both beginners and intermediate traders. There is a demo platform where traders can check the firm’s trading conditions and spreads. This is available for all trading platforms.

Overall, Funded Trading Plus seems competitive with its fees. Despite being slightly more expensive than other props, the firm offers a minimum of 12.5 funding for 119 dollars, which is very competitive.

? Platforms and Mobile Trading on Funded Trading Plus

Trading platform diversity and mobile trading are other crucial factors in prop trading.

Funded Trading Plus allows traders to access markets using several advanced and popular trading platforms including MetaTrader 4, MetaTrader 5, cTrader, and DXTrade.

These platforms are advanced software with plenty of built-in tools and support for custom indicators and trading robots. With diverse platform choices, Funded Trading Plus ensures every trader can comfortably speculate on markets using their favorite software.

Funded Trading Plus is also a mobile-friendly prop firm, as all of its platforms are offered for all mobile devices and tablets, including Android and iOS. Traders can even access demos of each platform to check their functionality and trading conditions. MT4 and MT5 support both custom indicators and EAs and so is the cTrader. DXTrade is a relatively new platform and lacks many indicators, especially custom ones.

? Education and research tools offered by Funded Trading Plus

Funded Trading Plus offers trading education and tutorials, making it a very beginner-friendly prop firm. There are video tutorials for each trading platform offered by the firm. These video tutorials will allow even the most beginner traders to start using advanced platforms, and gain practical knowledge on demo accounts.

The firm also offers a trading blog where traders can read many interesting facts about the firm and other prop trading-related staff. However, the blog is not designed for education and only focuses on tips and tricks. As for the tools, the firm allows traders to access an advanced trader dashboard and use performance measure tools and other useful plugins. Overall, the Funded Trading Plus educational section lacks many features but is decent enough to master trading platforms.

? Customer Support on Funded Trading Plus

Support is critical in prop trading because sometimes traders might need to solve the issues quickly to continue trading or close a position. Funded Trading Plus provides a FAQ section where almost all questions are answered. The firm also offers live chat and email channels, which is very useful in some cases. One interesting feature of Funded Trading Plus is that it offers hotline support, which is typically indicative of a legitimate firm. The firm is not shy to provide its address and phone number, which is always a good thing about the firm and adds to its safety. Both the website and support options are available in the English language.

Frequently Asked Questions

Is Funded Trading Plus a safe platform?

What is the Funded Trading Plus minimum deposit?

Does Funded Trading Plus have a mobile trading app?